Decoding the No Tax On Tips Act 2025: What It Means for You

The prospect of a “No Tax On Tips Act 2025” is a topic generating considerable buzz, particularly within the service industry. While no such act exists currently, the widespread discussion highlights a persistent desire for tax reform regarding tip income. This article delves into the complexities surrounding tip taxation in the United States, explores the potential implications of a hypothetical “No Tax On Tips Act 2025,” and examines the current legal framework governing tip reporting and taxation.

Understanding Current Tip Taxation in the US

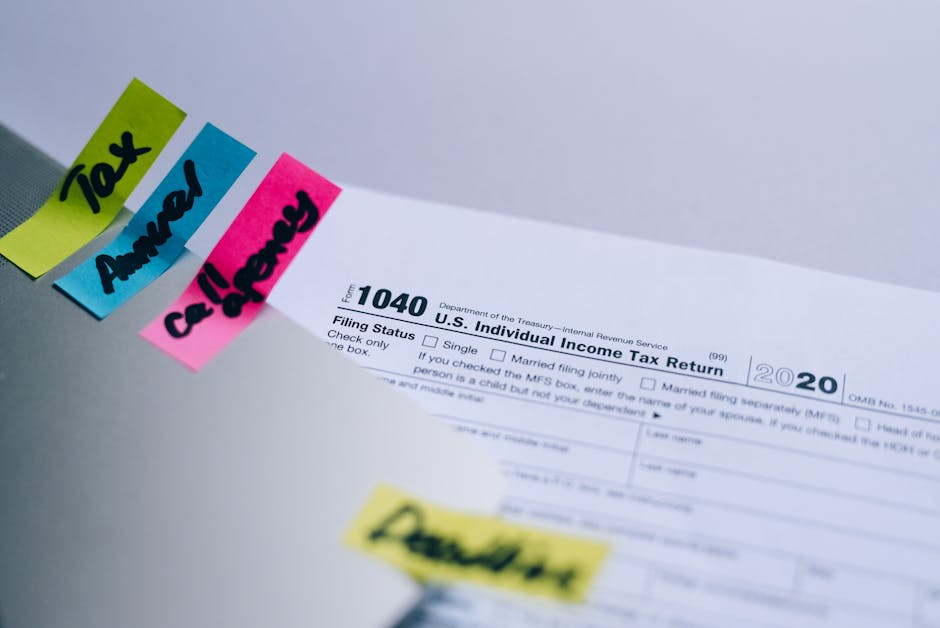

Currently, tips received by employees are considered taxable income by the Internal Revenue Service (IRS). This means that regardless of whether the tips are reported directly by the employer or declared by the employee themselves, they are subject to federal income tax, as well as state and possibly local taxes depending on the location.

The system involves several key components:

- Employer Reporting: Many employers require employees to report their tips regularly. This data is often used to calculate payroll taxes and ensure compliance.

- Employee Reporting: Employees are legally obligated to report all tips received, even those not reported by the employer, to the IRS. This involves completing Form W-2 and other relevant tax forms.

- Tip Credit: Employers can claim a tip credit against their social security and Medicare taxes if they meet specific requirements, which often involves maintaining accurate records of tip reporting.

- Penalties for Non-Compliance: Failure to accurately report tips can result in significant penalties, including back taxes, interest, and potential legal action.

The current system is designed to ensure fair taxation and prevent tax evasion. However, it’s also frequently criticized for its complexity and potential for inaccuracies, leading to significant burdens on both employees and employers.

The Hypothetical “No Tax On Tips Act 2025”: Exploring the Possibilities

The idea of a “No Tax On Tips Act 2025” represents a significant departure from the current system. A hypothetical act of this nature would likely involve eliminating the federal income tax on tip income. However, several crucial considerations would need to be addressed:

Potential Economic Impacts

Eliminating tip taxation could have a multitude of economic consequences. Some argue that it would boost the service industry by increasing employee income and potentially attracting more workers. On the other hand, critics might point to potential inflationary pressures, as businesses might increase prices to offset the loss of revenue from tip taxation.

Social Security and Medicare Implications

A major challenge would be how to address the social security and Medicare contributions typically derived from tip income. The current system relies on these contributions to fund vital social programs. A new funding mechanism would need to be established to offset the loss of revenue from tips if the tax was eliminated. This could potentially involve increased taxes on other income sources or adjustments to the benefit calculation system.

Enforcement and Compliance

Even with a “No Tax On Tips Act 2025,” ensuring accurate reporting of tips would remain crucial. Without a tax to incentivize honesty, methods for verifying tip income would need to be developed to prevent underreporting and ensure fairness across the industry. This could include enhanced auditing procedures and possibly the adoption of new technologies to monitor tip transactions.

State and Local Tax Implications

It’s important to remember that even if a federal tax on tips is eliminated, individual states and localities could still impose their own taxes on tips. This would add further complexity and create inconsistencies in taxation across different jurisdictions.

Alternative Approaches to Tip Tax Reform

Instead of a complete elimination of tip taxation, various alternative approaches could be considered to address the concerns surrounding the current system:

- Simplified Reporting Procedures: Streamlining the process of tip reporting for both employers and employees could significantly reduce administrative burdens.

- Increased Transparency: Improved transparency in how tips are handled and accounted for could increase trust and reduce disputes.

- Tax Credits for Low-Income Tipped Workers: Targeted tax credits for low-income individuals in the service industry could provide financial relief without eliminating the entire tax.

- Minimum Wage Adjustments: Increasing the minimum wage could lessen the reliance on tips as a primary source of income for service workers.

The Importance of Accurate Information

It’s crucial to clarify that as of the writing of this article, there is no actual “No Tax On Tips Act 2025” under consideration or in effect. Any claims suggesting otherwise should be treated with caution. Always consult official government sources, such as the IRS website, for accurate and up-to-date information on tax laws and regulations.

Conclusion

The discussion around tip taxation in the United States is complex and multifaceted. While the idea of a “No Tax On Tips Act 2025” appeals to many, especially within the service industry, its implementation would require careful consideration of potential economic, social, and administrative challenges. Alternative approaches to reforming the current system may offer more practical and effective solutions to address the concerns of both employees and employers.

Staying informed about tax laws and policies is crucial for everyone, particularly those working in the service industry. Always consult trusted sources for accurate information and seek professional advice when needed to ensure compliance with all applicable laws.