Decoding the No Tax on Tips Act: A Comprehensive Guide for Employees and Employers

The idea of a “No Tax on Tips Act” is a common misconception. There is no single federal law in the United States that eliminates the taxation of tips received by employees. Tips, regardless of their source or amount, are considered taxable income and are subject to federal, state, and sometimes local taxes. This article will delve into the complexities of tip taxation, clarifying common misunderstandings and providing guidance for both employees and employers.

The Reality of Tip Taxation

While a “No Tax on Tips Act” doesn’t exist, the taxation of tips does involve specific rules and regulations to ensure fair and accurate reporting. The Internal Revenue Service (IRS) requires both employees and employers to play a role in accurately reporting and paying taxes on tip income.

Employee Responsibilities Regarding Tip Income

- Accurate Tip Reporting: Employees are legally obligated to report all tips received, regardless of whether they’re reported to the employer or paid in cash or another form.

- Record Keeping: Maintaining meticulous records of tips received is crucial for accurate tax filing. This includes keeping receipts, copies of credit card transactions, and personal logs of cash tips.

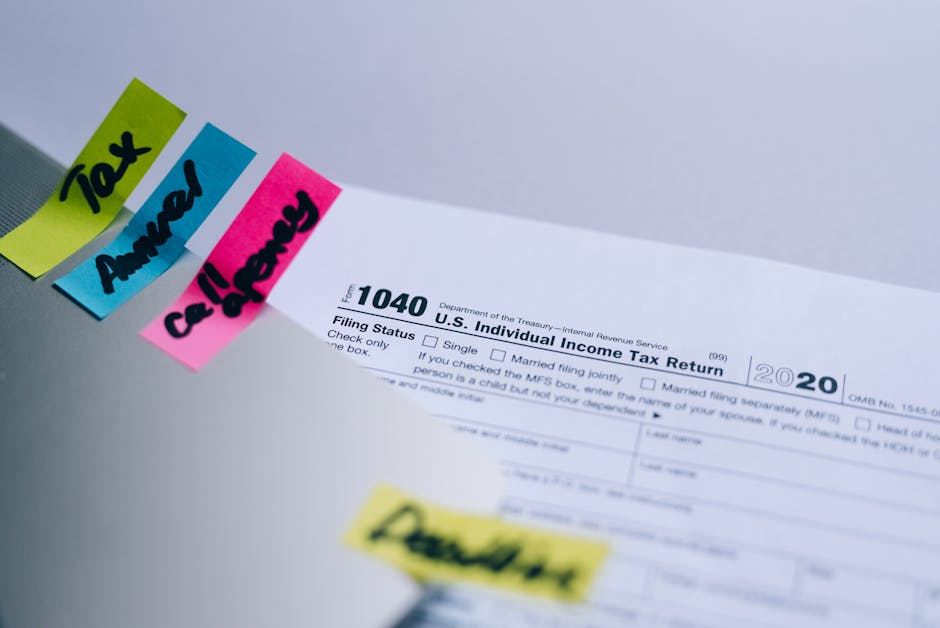

- Reporting on Tax Forms: Employees report their tips on Form W-2, Box 7, as well as on their personal income tax return (Form 1040).

- Understanding Employer Reporting: Even if an employer doesn’t directly receive all tip income, they still play a role in the reporting process. Employers must report their knowledge of an employee’s tip income, even if it comes from credit card tips or other means.

- Withholding Taxes: Employers might withhold taxes from reported tips. The employee should check their W-2 to verify the accuracy of tip reporting.

- Estimated Taxes: If tips exceed a substantial amount or are not subject to employer withholding, employees might need to make estimated tax payments throughout the year to avoid penalties.

Employer Responsibilities Regarding Tip Income

- Understanding Reporting Requirements: Employers have a legal duty to report the tips reported to them by their employees and to include that information on Form W-2.

- Credit Card Tips: Businesses that process credit card payments typically have access to records of tips paid via credit card. These amounts must be reported and included in the employee’s wages.

- Tip Allocation: In some cases, employers may allocate tips amongst employees, which can be a complex process and must be done in accordance with IRS guidelines.

- Tip Pooling Arrangements: Certain establishments might implement tip pooling, where tips are shared among employees. These arrangements need to be transparent and documented appropriately.

- Payroll Tax Withholding: Employers are obligated to withhold income taxes, Social Security taxes, and Medicare taxes from reported tips, just as they would with regular wages.

- Compliance with State and Local Laws: Remember that state and local laws governing tip reporting and taxation can differ from federal regulations. Employers need to be compliant with all applicable laws.

Common Misconceptions About Tip Taxation

The notion of a “No Tax on Tips Act” often stems from confusion surrounding several aspects of tip taxation. Let’s clarify some of these:

Myth 1: Cash Tips Are Untaxable

This is completely false. All tips, regardless of payment method (cash, credit card, or other), are considered taxable income and must be reported.

Myth 2: Only Reported Tips Are Taxable

Employees are legally obligated to report all tips received, even if they’re not reported to the employer. Failure to report all tips can lead to significant penalties from the IRS.

Myth 3: Tips Are Not Subject to Withholding

While the employer might not directly withhold taxes from all tips, the employee is still responsible for paying taxes on their total tip income. This may involve paying estimated taxes quarterly if enough tips are earned to require more than the employer’s withholding.

Myth 4: Small Amounts of Tips Don’t Need to be Reported

Every dollar of tip income is reportable, regardless of how small it may seem. Accurate reporting is crucial, even if the amounts are minimal.

Penalties for Non-Compliance

Failure to accurately report and pay taxes on tip income can result in significant consequences, including:

- Back Taxes: Owed taxes plus interest and penalties for late filing.

- Interest and Penalties: Additional fees assessed for failing to file or pay taxes on time.

- Criminal Charges: In extreme cases of intentional tax evasion, criminal charges can be filed.

Seeking Professional Advice

Navigating the complexities of tip taxation can be challenging. Both employees and employers are strongly encouraged to seek professional guidance from tax advisors or accountants. They can provide personalized advice based on individual circumstances and ensure compliance with all applicable laws and regulations. The IRS also provides numerous resources, including publications and online tools, to help individuals understand their obligations.

Conclusion

While the concept of a “No Tax on Tips Act” is a misconception, understanding the rules and regulations surrounding tip taxation is essential. Accurate reporting and compliance are crucial for both employees and employers to avoid potential penalties and ensure a smooth tax filing process. Remember to maintain detailed records, utilize available resources, and seek professional advice when needed.