Did the Senate Pass a Bill to Eliminate Taxes on Tips? Unpacking the Truth About Tip Taxation

The question of whether the Senate has passed a bill to eliminate taxes on tips is a common one, often fueled by misinformation and wishful thinking. The short answer is: no, there is no federal legislation that has eliminated or significantly altered the taxability of tips received by employees. This article will delve into the complexities of tip taxation in the United States, examining the relevant laws, clarifying widespread misconceptions, and exploring the ongoing debate surrounding this issue.

Understanding Tip Taxation in the US

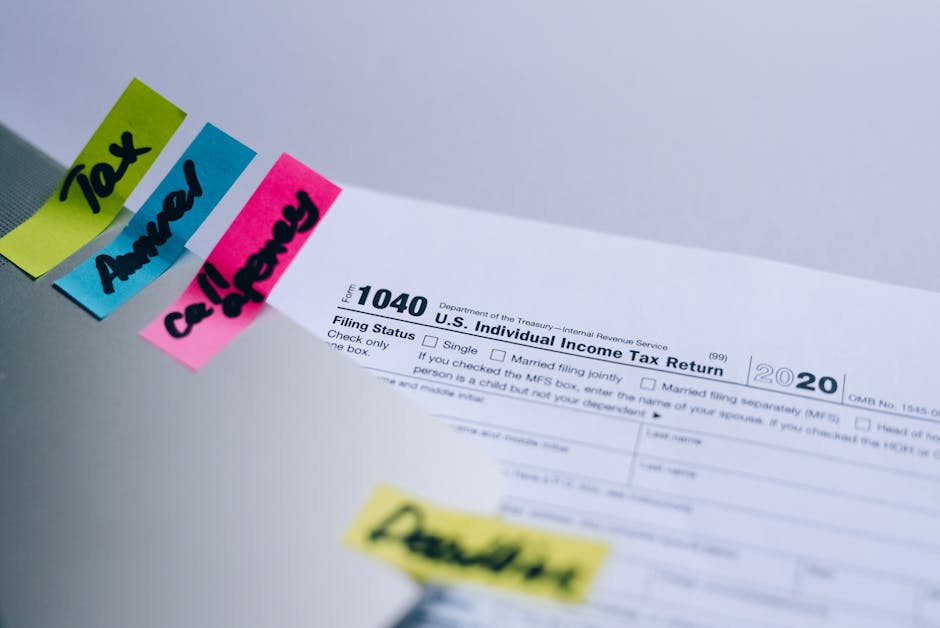

Tips, regardless of how they are received (cash, credit card, or other means), are considered taxable income in the United States. This is a long-standing principle governed by the Internal Revenue Service (IRS). Employees are legally obligated to report all tips received, and employers often play a role in this reporting process. The employer’s responsibility is largely centered around record-keeping and facilitating the correct reporting of these earnings. They may also be responsible for withholding taxes if the employee hasn’t properly reported their tips.

The IRS employs various methods to ensure compliance. These include:

- Employee reporting: Employees are required to report their tips on their tax returns, typically using Form W-2.

- Employer reporting: Employers are often required to report tips received through credit card payments and other electronic means.

- Tip allocation: In some cases, employers may allocate tips among employees, based on factors such as hours worked and positions held.

- Audits: The IRS conducts regular audits to ensure that both employees and employers comply with tip reporting regulations.

Penalties for Non-Compliance

Failure to accurately report tips can lead to significant penalties, including back taxes, interest charges, and potentially even criminal prosecution in cases of deliberate tax evasion. It’s crucial for both employees and employers to understand and adhere to the legal requirements surrounding tip reporting.

The Myth of Tax-Free Tips: Where it Originates

The persistent belief in tax-free tips likely stems from several sources:

- Misunderstanding of tax laws: Many individuals are unaware of the specific regulations governing tip taxation.

- Informal economy: In cash-heavy industries, under-reporting of tips is more common, creating a perception that the practice is widespread and accepted.

- Social media misinformation: False or misleading information often circulates on social media platforms, leading to confusion and inaccurate beliefs.

- Desire for greater income: The desire to keep more of their earnings after a long shift often fuels the false belief in tax-free tips.

Recent Legislative Attempts and Their Outcomes

While numerous proposals concerning tax reform have been introduced in both the House and Senate over the years, none have successfully eliminated or drastically altered the taxability of tips. Often these proposals focus on broader tax reform measures, not specifically targeting tips. Proposals aiming to simplify tax reporting for tips have been discussed, but have not progressed to enactment.

Specific instances of bills that haven’t passed, and why, should be added here, with links to official sources (congressional record, etc.) for further verification. This section needs to be updated regularly to reflect the current legislative landscape.

Employer Responsibilities Regarding Tip Reporting

Employers have a significant role in ensuring accurate tip reporting. Their responsibilities typically include:

- Maintaining records: Employers must keep accurate records of all tips reported by employees, whether received in cash or electronically.

- Credit card tip reporting: Employers are required to report tips received through credit card payments to both the employee and the IRS.

- Tip allocation (where applicable): In some establishments, employers allocate tips amongst employees based on specific criteria.

- Providing information to employees: Employers have a duty to provide their employees with clear and accurate information about their tip reporting obligations.

- Withholding taxes: Employers may withhold taxes from an employee’s wages if they believe the employee has not accurately reported their tips.

The Impact of Tip Taxation on the Service Industry

The taxability of tips has a notable impact on workers in the service industry. While the tax burden is a factor, it’s important to note that tips often represent a substantial portion of a service worker’s income. Accurate reporting allows these workers to receive proper social security and Medicare benefits based on their full earned income.

Navigating Tip Taxation: Resources and Advice

For both employees and employers, understanding and complying with tip taxation laws is essential. The IRS provides comprehensive resources to clarify any ambiguities or address specific queries. Employees should consult with a tax professional for guidance on accurate reporting. Employers should ensure they have the necessary systems in place to properly manage and report employee tips.

This includes utilizing appropriate software and staying up-to-date on any changes to relevant tax laws. The consequences of non-compliance can be severe, underscoring the importance of accurate and timely reporting.

Conclusion

The assertion that the Senate has passed a bill to eliminate taxes on tips is inaccurate. Tips remain taxable income under current US law. It’s crucial for all individuals involved in industries where tips are prevalent to understand and adhere to the legal requirements regarding their reporting. Misconceptions about tip taxation persist, but accurate information and resources are readily available to ensure compliance and avoid potential penalties. Staying informed about legislative changes and utilizing available resources is paramount in navigating the intricacies of tip taxation in the United States.